Chicken Farming Stats and Overview South Africa

Chicken farming is a significant agricultural sector in South Africa, contributing to the country’s food security and economic development. Here is an overview of chicken farming in South Africa, including some statistics:

Poultry Industry Overview:

South Africa has a well-established poultry industry that includes the production of broilers (meat chickens), layers (egg-laying hens), and other poultry products.

The poultry industry is one of the largest segments within the South African agricultural sector.

Broiler Production:

Broiler chickens are raised primarily for meat production.

Broiler farming in South Africa is characterized by large-scale commercial operations that use modern and efficient production methods.

Layer Production:

Layer hens are raised for egg production.

The South African layer industry is also highly industrialized, with a focus on producing table eggs for consumption.

Market Share:

The South African poultry industry is dominated by a few major companies, including Astral Foods, RCL Foods, and others.

Consumption and Demand:

Chicken meat is a staple in the South African diet, and the demand for poultry products, especially chicken meat, remains high due to its affordability and versatility.

Chicken is a popular source of protein in the country and is consumed in various forms, including whole chickens, chicken pieces, and processed chicken products.

Challenges:

The South African poultry industry faces challenges such as disease outbreaks, high feed costs, and competition from imported poultry products, which can impact local producers.

Government Regulations:

The South African government has implemented various regulations to ensure food safety and animal welfare standards in poultry production.

Exports:

South Africa occasionally exports poultry products, including chicken meat and eggs, to neighboring countries and international markets.

Statistics (as of 2020):

South Africa was estimated to have produced approximately 2 million metric tons of poultry meat in 2020.

The country’s annual per capita chicken meat consumption was estimated to be around 38 kilograms per person in 2020.

The layer industry produced over 10 billion table eggs in 2020.

The poultry industry employed a significant number of people in various roles, from farm workers to processing plant employees.

Chicken Farming Stats

The population of live chickens in Africa from 2010 to 2020.

In the year 2020, Africa recorded a count of over 2.07 billion live chickens, marking a continuation of the consistent upward trend that has been evident since 2012. Morocco and South Africa stood out as the countries with the largest chicken populations on the continent during that particular year. In the preceding year, approximately 2.06 billion chickens were documented.

Live Chickens in South Africa 2010 to 2020

In the year 2020, South Africa boasted a chicken population of nearly 180 million individuals, marking a slight uptick from the previous year’s count of 178 million. The zenith of chicken population in the country was reached in 2011 and 2012 when it peaked at 200 million. Furthermore, the total number of chickens slaughtered in South Africa in 2020 amounted to 968 million individuals.

The volume of chicken production in South Africa from 2010 to 2020

In 2020, South Africa’s chicken production volume reached almost 968 million individuals. This marked a slight increase from the previous year, which stood at around 966.1 million. Over the examined period, chicken production volume fluctuated, reaching its peak in 2012 with over 1.05 billion individuals and hitting its lowest point in 2018 at nearly 886.9 million. In 2020, chickens were the predominant livestock species in terms of production in the country. Source

The 2021 meat export quantities from South Africa, categorized by type

Chicken was the primary type of meat exported from South Africa in 2021, with the country shipping out nearly 6.45 million individuals. Additionally, meat from horses and sheep ranked next, with approximately 127.08 thousand and 88.14 thousand individuals exported, respectively.

The 2021 meat import quantities into South Africa, categorized by type

Chicken emerged as the primary meat variety imported into South Africa in 2021, with imports totaling nearly 346 thousand metric tons. Subsequently, meat meal and turkey followed with import volumes of 63.2 thousand and 25.28 thousand metric tons, respectively. Additionally, approximately 24.31 thousand metric tons of pig meat were imported into the country. Source

The inventory of living animals in South Africa for the year 2021, categorized by species.

In 2021, South Africa’s living animal population comprised approximately 171 million chickens, with sheep, cattle, and goats following at 21.46 million, 12.23 million, and 5.16 million individuals, respectively. In contrast, the number of mules in the country stood at a mere 15.9 thousand during the same year.

The per capita consumption of poultry meat in South Africa from 2010 to 2017

This data the per capita consumption of poultry meat in South Africa between 2010 and 2017. In 2016, the per capita consumption of poultry meat in South Africa stood at approximately 40 kilograms, and it was estimated to have increased to 41.2 kilograms per capita in 2017

Poultry Industry Profile for the South African Poultry Association

Egg industry in South Africa

Overview – Source SA Poultry

In 2019, egg producers faced a challenge due to an imbalance between supply and demand. Surprisingly, the global COVID-19 pandemic and associated lockdowns contributed to correcting this imbalance. In 2020, domestic demand for eggs in South Africa increased by 4.4%, leading to firmer egg prices throughout the year. This surge in demand resulted in a record high per capita consumption of eggs in 2020. However, as lockdown restrictions eased and egg prices softened from January to April 2021, demand began to decline. This decline occurred despite significant increases in feed prices starting in September 2020.

One notable concern is the considerable gap between what producers and retailers receive for a dozen eggs. The retail mark-up on producer prices soared from 62.8% in 2018 to 120% in 2021. The substantial 18.8% increase in feed prices throughout the year put immense pressure on profit margins. Farm gate egg prices, in contrast, only increased by 8.1% despite the escalating feed costs.

It has been three years since the 2017 H5N8 HPAI outbreaks. South African producers invested in biosecurity measures, and despite surging cases of avian influenza in Europe and Asia, there was no resurgence of the virus in South Africa during the winter of 2019 or 2020. However, the first case of H5N1 HPAI in South Africa was reported in Gauteng in March 2021, and despite containment efforts, the outbreak spread to other provinces, with the Western Cape being particularly hard-hit.

The egg industry suffered more than the broiler industry, losing nearly 2.39 million laying hens and pullets (see Chapter 8.2). As a result of the H5N1 outbreak, and despite a 1.9% increase in day-old pullet production, the laying flock decreased by an estimated 6.4% in 2021. Egg production also dropped in line with the decline in hen numbers, helping to stabilize supply and demand and at least maintain positive price increases year-on-year.

In August, the Department of Agriculture, Land Reform and Rural Development (DALRRD) confirmed that no compensation would be provided by the government for the destruction of “healthy but at-risk” commercial chickens, even if the official directive to cull came from a state veterinarian. Compensation could only be claimed for sick birds culled. This decision, in contrast to the World Organisation of Animal Health (OIE) recognizing the role of farmers in early HPAI detection, is considered shortsighted and may hinder efforts to control the virus’s spread. These economic losses were particularly challenging for small commercial egg producers.

In July, a 10-day rampage of rioting and looting wreaked havoc on the economies of KwaZulu-Natal and Gauteng in South Africa. Numerous poultry farms fell victim to attacks characterized by vandalism and theft. This wave of destruction had severe repercussions for many egg producers. The widespread damage to shopping malls and smaller wholesale and retail establishments led to the cancellation of orders and delayed payments from customers.

During this period of lawlessness, shops in the affected areas remained closed, compelling farmers to resort to direct sales to consumers. Interestingly, this shift resulted in producers earning more while consumers paid less for eggs, highlighting the stark disparity in the cost of doing business with the retail sector. This situation mirrors a common challenge faced by egg producers globally: when feed prices surge dramatically, the substantial gap between producer and retail egg prices makes production economically unsustainable.

South Africa maintains self-sufficiency in table egg production, even in the face of the 2021 HPAI outbreaks, negating the need to import shell eggs. However, imports of egg products, such as albumins and dried yolks from the Gallus gallus domesticus, saw a significant increase of 63.4% as international borders reopened for trade. Unfortunately, South African egg exports, including table eggs, declined by 53.5% due to trade restrictions related to HPAI. Currently, exports represent less than 1% of local egg production.

Regarding per capita egg consumption, South Africa ranked 33rd out of 38 countries that submitted data to the International Egg Commission (IEC) in 2021. Per capita consumption has dipped from its peak of 159 eggs per person per year reached in 2020.

To promote egg consumption among South African consumers, the Egg Organisation continued its generic egg marketing campaign, initiated a year ago. The campaign aims to educate consumers about the versatility and health benefits of eggs. It involves monthly media releases with recipes and photography distributed to various print and online publications. Additionally, educational advertorials containing health information and egg recipes were published in the “Heita My Friends” magazine, distributed free of charge to 40,000 commuters at the 10 largest taxi ranks in Gauteng.

Turnover

With a gross turnover of R11.44 billion at the producer level, eggs maintain their rank as the fourth-largest sector in animal product agriculture in South Africa. This position comes after poultry meat (R50.96 billion), beef (R43.01 billion), and milk (R21.17 billion), according to data from the Department of Agriculture, Land Reform, and Rural Development (DALRRD). Notably, the turnover saw a modest increase of 0.9% compared to 2020, following a 2.4% annual increase in the preceding year.

Eggs accounted for 7.3% of the gross value of animal products and 3.1% of the entire agricultural production in South Africa, which was a decrease from 7.8% and 3.4%, respectively, in the previous year.

The total estimated value of eggs at the retail level reached R24.03 billion in 2021. This substantial value was attributed to the sale of approximately 707 million dozen eggs throughout the year via various distribution channels.

Production

Laying Flock

In 2019, adjustments were made to the forecasting model used for predicting bird numbers and egg volumes. These modifications included extending the laying cycle from 74 to 78 weeks of age and applying new breed standards to the model. As a result of these changes, there was an increase in the estimated size of the national laying flock, the number of cases of eggs produced, and the mean egg weight.

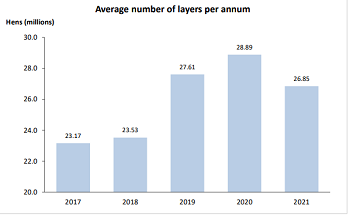

However, in 2021, the national laying flock saw a significant decrease of 7.1%, falling from 28.89 million hens to 26.85 million hens (as depicted in Figure 12). This decline was primarily attributed to the culling of over 2 million laying hens during the outbreak of HPAI (Highly Pathogenic Avian Influenza). The substantial growth in bird numbers observed in 2019 was a consequence of the adjustments made to the forecasting model and an increase in actual day-old pullet production. Additionally, the unusually high egg producer prices in 2018 contributed to the stocking of layer farms to full capacity and the expansion of production facilities.

Egg production

The second half of 2017 witnessed a significant and abrupt decline in egg production due to the culling of large flocks as a result of HPAI (Highly Pathogenic Avian Influenza) outbreaks, as illustrated in Figure 13. Subsequently, in 2018, as farms were repopulated, egg production embarked on a steady increase. The trend continued into 2019 and the first quarter of 2020, driven by the rising number of hens, resulting in a surplus of eggs in the market.

However, a noteworthy development occurred during the initial stages of the COVID-19 lockdown in March 2020, as there was a remarkable surge in demand for eggs. This sudden increase in demand played a crucial role in stabilizing the balance between egg supply and demand.

In 2021, egg numbers once again decreased, aligning with the drop in hen numbers due to the culling necessitated by HPAI-related issues.

The average weekly production in 2021 stood at 451,815 cases, reflecting a decline of 35,066 cases (equivalent to -7.2%) per week. This drop in production resulted in a total egg production for the year amounting to 23.555 million cases, equivalent to 706.7 million dozen eggs. This represented a notable decrease of 7.5% in comparison to the production levels seen in 2020. For more detailed information, please refer to Table 6, which provides a summary of bird-related data.

Beginning in mid-2018, oversupply issues in the South African egg market were exacerbated by unexpected imports of shell eggs from Brazil. By October 2018, production had surged, registering a 20% increase compared to October 2017. This was due to the successful repopulation of farms affected by HPAI (Highly Pathogenic Avian Influenza). Consequently, by December 2018, producer prices had dropped nearly 15%, compared to the inflated prices seen in December 2017.

Throughout 2019, producer prices demonstrated an inverse relationship with egg volumes. In January 2019, egg volumes were 23.9% higher than those in January 2018, but producer prices were 21% lower. By December 2019, the annual increase in egg volumes had moderated to +12.7%, and producer prices were 7.9% below December 2018 prices.

In 2020, supply and demand found better balance. As the number of egg cases produced gradually fell below the previous year’s levels, producer prices started to rise, particularly during the lockdown months when there was strong demand for eggs. However, the year-on-year increase in egg prices, observed from March 2020 onwards, was not as pronounced as the surge seen in 2017/2018 when the national flock was being rebuilt after the HPAI epidemic. Tighter egg stocks from mid-2020 onwards created a more favorable market position in 2021, emphasizing the importance of disciplined supply management. The initial oversupply of eggs in early 2021 transitioned into a more balanced situation following the H5N1 HPAI outbreak.

Egg prices at the producer and retailer levels

In 2021, the average price for producer eggs (including cage, barn, and free-range) was R16.89 per dozen, representing a significant increase of 14.7% compared to the average price in 2020, which was R14.72 (as reported by SAPA). Graded eggs, on average, sold for R17.25 per dozen, while ungraded eggs were priced at R14.75 per dozen.

Throughout 2021, approximately 85% of eggs were sold in graded form, while the remaining 15% were ungraded.

In the same year, the average retail price for large-sized eggs was R34.01 per dozen, as reported by Stats SA. This retail price saw a modest increase of 0.5% compared to 2020 prices, which is notably lower than the substantial 14.7% increase in producer prices. Using SAPA producer prices as a reference, the estimated mark-up on large-sized eggs in 2021 stood at 120%.

Chicken Farming Stats and Overview South Africa

YouTube Channel: Farming South Africa

Facebook Page: Farming Life

Back To Home Page: Farming South Africa

Chicken Farming Stats and Overview South Africa

Tags for this post: Chicken Farming Stats and Overview South Africa, chicken farming, chicken farming stats, chicken stasts, farming stats South Africa, stats and overview South Africa, Chicken Stats and overview,