7 Ways Ukraine-Russia Conflict Impacts SA Farming

The war between Ukraine and Russia could potentially influence farming in South Africa in several ways:

- Global Agricultural Markets: Ukraine is a major exporter of agricultural commodities such as wheat, corn, and sunflower oil. If the conflict disrupts Ukraine’s agricultural production or logistics, it could lead to changes in global supply and demand dynamics. This might affect prices for similar commodities produced in South Africa, potentially creating both challenges and opportunities for South African farmers depending on their specific crops.

- Trade Relationships: South Africa may need to adapt its trade relationships due to changes in global trade patterns resulting from the conflict. This could involve seeking new markets for its agricultural exports if traditional trading partners are affected by disruptions in Ukraine or Russia. Alternatively, there could be increased demand for South African agricultural products if other countries seek alternative sources due to disruptions in Ukrainian or Russian supply.

- Input Costs: Any disruptions in global markets could impact input costs for South African farmers, including fertilizers, pesticides, and machinery that may be sourced internationally. Changes in the prices of these inputs could affect the profitability of farming operations in South Africa.

- Currency Fluctuations: Instability in global markets often leads to fluctuations in currency exchange rates. If the conflict affects global economic stability, it could influence the value of the South African rand relative to other currencies. This, in turn, could impact the competitiveness of South African agricultural exports and the cost of imported agricultural inputs.

- Investment and Financing: Uncertainty and instability resulting from the conflict could affect investment and financing in the South African agricultural sector. Investors may become more cautious, leading to reduced investment in farming operations or agricultural infrastructure. Additionally, lenders may adjust their terms and conditions for providing financing to farmers, potentially affecting their ability to access capital for expansion or operational needs.

- Fertilizer prices: Ukraine is also a significant producer of fertilizers, particularly nitrogen-based fertilizers. Any disruption in fertilizer production or transportation from Ukraine could lead to higher fertilizer prices globally. South African farmers heavily reliant on imported fertilizers from Ukraine may face increased input costs, affecting their profit margins.

- Market volatility: The geopolitical tensions between Ukraine and Russia could lead to increased market volatility and uncertainty in global agricultural markets. South African farmers exporting their products internationally might face challenges in predicting market conditions and securing stable prices for their goods.

7 Ways Ukraine-Russia Conflict Impacts SA Farming

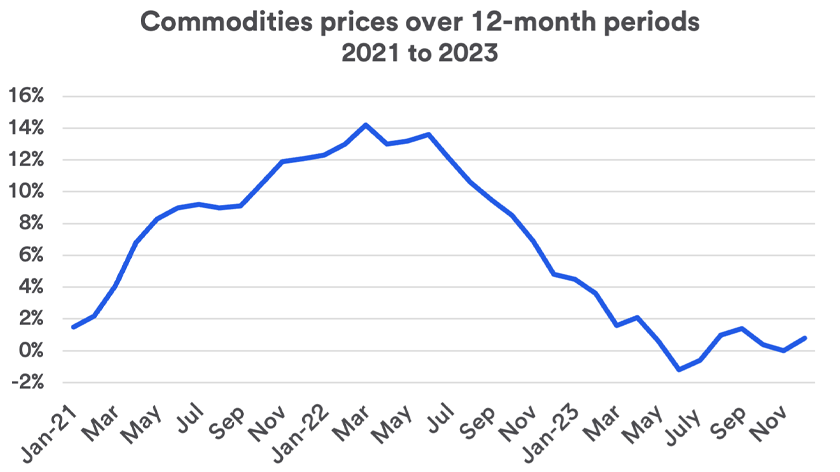

Global Commodity Prices Explained

The war between Ukraine and Russia could have a significant impact on global commodity prices, particularly for agricultural products such as wheat, corn, and barley. Here’s how:

- Wheat: Both Ukraine and Russia are major exporters of wheat, collectively accounting for a significant portion of global wheat exports. Any disruption in their production or exports due to the conflict could tighten global supply, leading to higher wheat prices. This increase in prices could affect food prices worldwide, including in South Africa, where wheat imports might become more expensive.

- Corn: Ukraine is also a major exporter of corn. Any disruption in Ukrainian corn production or exports could lead to tighter global supply and higher prices. This could impact South Africa, which imports corn for both human consumption and animal feed, potentially leading to increased costs for farmers and consumers.

- Barley: Ukraine and Russia are important barley exporters as well. Disruptions in their production and exports could tighten global barley supply, leading to higher prices. This could affect South African farmers who use barley for animal feed or in the brewing industry.

- Soybeans and other commodities: While Ukraine and Russia are not as significant in global soybean production and exports compared to countries like the United States and Brazil, disruptions in the Black Sea region could still have ripple effects on other commodities due to market uncertainties and changes in trade flows.

Trade Relationships Explained

The conflict could lead to increased volatility and upward pressure on global commodity prices, affecting South African farmers through higher input costs and potentially impacting food prices domestically. However, the extent of the impact would depend on various factors, including the duration and intensity of the conflict, as well as how other major agricultural producers respond to any supply disruptions from Ukraine and Russia.

Input Costs Explained

The war between Ukraine and Russia could influence input costs for South African farmers in several ways:

- Fertilizers: Ukraine is a major global exporter of fertilizers, particularly nitrogen-based fertilizers. Any disruption in fertilizer production or transportation from Ukraine could lead to higher fertilizer prices globally. South African farmers who rely on imported fertilizers may face increased input costs, affecting their profit margins.

- Fuel prices: Conflict in the Black Sea region could lead to increased geopolitical tensions and uncertainty, potentially affecting global oil markets and leading to higher fuel prices. This would impact South African farmers who use fuel for machinery, transportation, and irrigation, increasing their operational expenses.

- Equipment and machinery: If the conflict leads to disruptions in global supply chains or increases in manufacturing costs, it could result in higher prices for agricultural equipment and machinery imported by South African farmers. This would increase the capital investment required for farming operations.

- Seeds and pesticides: Any disruption in trade routes or supply chains due to the conflict could lead to delays or shortages in the availability of seeds and pesticides for South African farmers. This could result in higher prices for these inputs, impacting farmers’ production costs.

- Interest rates and financing: Geopolitical tensions and market uncertainty could influence interest rates and access to financing. Higher interest rates or difficulty in obtaining loans could increase the cost of capital for farmers, affecting their ability to invest in inputs and expand their operations.

Currency Fluctuations Explained

The war between Ukraine and Russia could also result in currency fluctuations, which could impact South African farming in several ways:

- Exchange rate volatility: Geopolitical tensions and uncertainty can lead to fluctuations in currency exchange rates. If investors perceive increased risk associated with the conflict, they may move their investments to safer currencies, causing the value of the South African rand to fluctuate against other currencies.

- Export competitiveness: A depreciation of the South African rand relative to other currencies could make South African agricultural products more competitive in international markets. This could benefit farmers by increasing the value of their export earnings in local currency terms.

- Import costs: On the other hand, a depreciating rand could also lead to higher costs for imported agricultural inputs such as fertilizers, machinery, and pesticides. This would increase production costs for South African farmers, potentially reducing their profitability.

- Inflationary pressures: Currency depreciation can contribute to inflationary pressures by increasing the cost of imported goods and raw materials. Higher inflation could erode farmers’ purchasing power and affect consumer demand for agricultural products domestically.

- Interest rates: Central banks may respond to currency fluctuations and inflationary pressures by adjusting interest rates. Higher interest rates could increase borrowing costs for farmers, impacting their investment decisions and overall profitability.

7 Ways Ukraine-Russia Conflict Impacts SA Farming

Investment and Financing Explained

The war between Ukraine and Russia could affect investment and financing in South African farming in several ways:

- Access to capital: Increased global uncertainty and risk aversion could make it more challenging for South African farmers to access financing. Lenders may become more cautious, leading to tighter credit conditions and higher borrowing costs for agricultural investments.

- Investment decisions: Uncertainty surrounding the conflict could lead to delays or cancellations of investment projects in the agricultural sector. Farmers may postpone expansion plans or investment in new technologies and infrastructure until there is more clarity about the geopolitical situation and its potential impact on markets.

- Government support: Governments may respond to economic challenges stemming from the conflict by implementing policies to support the agricultural sector. This could include measures such as subsidies, loan guarantees, or investment incentives to help farmers cope with higher input costs and market volatility.

- Foreign investment: Geopolitical tensions may lead to a decrease in foreign investment in South African agriculture. Investors may perceive the country as riskier, leading to capital outflows and reduced funding for agricultural projects and ventures.

- Risk management: The conflict highlights the importance of effective risk management strategies for farmers. This may involve diversifying markets, hedging against currency and commodity price fluctuations, and maintaining adequate reserves to withstand economic shocks.

Fertilizer prices Explained

The war between Ukraine and Russia could have a notable impact on fertilizer prices globally, including in South Africa. Here’s how:

- Supply Disruption: Ukraine is one of the world’s largest producers and exporters of fertilizers, particularly nitrogen-based fertilizers. Any disruptions to fertilizer production or transportation infrastructure in Ukraine could lead to a decrease in global fertilizer supply, causing prices to rise.

- Export Restrictions: In times of geopolitical tension or conflict, exporting countries may impose export restrictions on critical commodities like fertilizers to ensure domestic supply. If Ukraine restricts fertilizer exports or if shipping routes are affected by the conflict, it could further tighten global fertilizer supply and contribute to price increases.

- Increased Demand: Despite potential disruptions, global demand for fertilizers remains steady, driven by the need to increase agricultural productivity to feed a growing population. If supply constraints occur due to the conflict, demand could outstrip supply, exerting additional upward pressure on fertilizer prices.

- Currency Fluctuations: Currency fluctuations resulting from the conflict may also impact fertilizer prices. If the South African rand weakens against major currencies due to market uncertainty, it could lead to higher import costs for fertilizers, further driving up prices for South African farmers.

- Input Costs for Farmers: Higher fertilizer prices would directly affect South African farmers’ input costs, potentially squeezing their profit margins. Farmers may need to adjust their fertilizer usage, explore alternative sources, or consider hedging strategies to mitigate the impact of price increases.

Market Volatility Explained

The war between Ukraine and Russia could contribute to increased market volatility globally, including in agricultural markets, which could affect South African farming in several ways:

- Commodity Price Fluctuations: Geopolitical tensions often lead to uncertainty in financial markets, which can result in increased volatility in commodity prices. Agricultural commodities such as wheat, corn, and soybeans may experience heightened price fluctuations due to concerns about potential supply disruptions from Ukraine and Russia. South African farmers exporting these commodities could face challenges in predicting and managing their revenues amidst such volatility.

- Currency Exchange Rate Volatility: Geopolitical events can also impact currency markets, leading to fluctuations in exchange rates. A depreciation of the South African rand relative to major currencies could affect the competitiveness of South African agricultural exports and increase input costs for farmers who rely on imported equipment, fertilizers, and pesticides.

- Investor Sentiment: Market uncertainty stemming from geopolitical tensions may influence investor sentiment, leading to shifts in capital flows and speculative activity. This could exacerbate price swings in agricultural markets and other asset classes, making it more difficult for farmers to make informed decisions about production, marketing, and risk management.

- Trade Disruptions: Any disruptions to global trade routes or export infrastructure in the Black Sea region could impact the flow of agricultural commodities and inputs. Delays or interruptions in shipments could disrupt supply chains and contribute to market volatility, affecting both producers and consumers in South Africa and abroad.

- Risk Management Challenges: Heightened market volatility presents challenges for farmers in managing price and production risks. Farmers may need to implement effective risk management strategies, such as futures contracts, options, or forward contracts, to protect themselves against adverse price movements and ensure the financial stability of their operations.

Market volatility is an inherent aspect of agricultural markets, geopolitical events like the conflict between Ukraine and Russia can amplify uncertainty and increase the frequency and magnitude of price fluctuations. South African farmers should stay informed about global market developments and be prepared to adapt their strategies to navigate the challenges posed by increased volatility.

While the direct impact of the war between Ukraine and Russia on South African farming may be limited, the interconnectedness of global agricultural markets means that any significant disruptions can have ripple effects that are felt across the world, including in South Africa. Adaptability, diversification, and staying informed about global market dynamics would be essential for South African farmers to navigate potential challenges and capitalize on opportunities arising from the situation.

7 Ways Ukraine-Russia Conflict Impacts SA Farming – By Malcolm Heyns

YouTube Channel: Farming South Africa

Facebook Page: Farming Life

Back To Home Page: Farming South Africa

7 Ways Ukraine-Russia Conflict Impacts SA Farming